Ferrari F40 (1987-1992) – Part II

Note: This page continues the Ferrari F40 market analysis begun in Part I. If you are lost and looking for the beginning, you can find it here.

European vs. US specification, North American market | Model year, US-specification | Mileage, by specification | Restoration | Modification | Originality | Repaints outside of ‘Rosso Corsa’ | Books, tools, and Schedoni luggage | Notable prior ownership | Concours awards | Auction results vs. asking prices | Auction results vs. estimates | Epilogue

European vs. US specification, North American market

In Part I we examined the price difference between European and US-specification F40s at auction. There, we considered global sales, and an unequal mixture of regional markets between the specifications could have affected prices. US-specification F40s trade almost exclusively in North America; in fact the last example to go to auction overseas did so in 2019 (in Saudi Arabia). Meanwhile, European-specification examples trade around the world. This includes North America; European F40s have regularly made their way over to the United States since reaching the 25-year import age. Europe does not have the same taste for US-specification examples – likely the result of US cars trading at higher prices, import rules and costs being potentially prohibitive, European buyers preferring the original product, and there being so many European-specification options floating around the continent already.

To eliminate a potential price variance coming from differing markets, let’s compare the two major specifications while focusing on North America-based auctions only.

After limiting the data to North America, we still see that a premium is typically paid for US-specification examples. Several European-specification offerings have hit the North American market, and most were sold or bid to below the US-specification average. Two of the three exceptions were results involving the same ultra-low-mileage, European-specification F40 example.

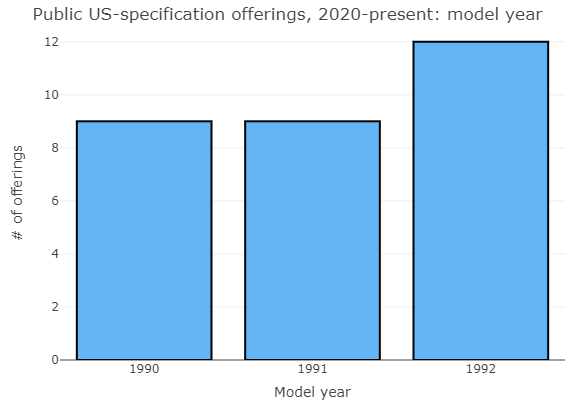

Model year, US-specification

We already looked at model year in Part I. Here, we will consider it specifically for the US-specification model. I often hear the claim that 1992 US-specification F40 examples are more valuable than the rest, as they are the rarest among the three model years sold for that specification. Indeed, 1992 had the lowest production by far.

| Model year | Number produced, US-specification |

| 1990 | 90-93 |

| 1991 | 96-101 |

| 1992 | 20-22 |

| TOTAL | 211 |

Despite the above figures, 1992 examples appear on the market more often than examples from either of the other two model years. What is going on here?

I have seen the production number for the 1992 model year quoted as high as 60 by some reputable sources, with the difference coming out of the number for 1991. The large discrepancy between 20 and 60 is apparently attributable to varying accounting for examples built in late 1991. Whether this is responsible or not for ‘1992’ examples being offered more frequently than 1990 and 1991 examples is unclear.

Production number fogginess aside, is there truth to the ‘1992 premium’? Are these examples actually achieving higher results than 1990-1991 cars?

When looking solely at model year, there does not appear to be a premium or discount in value for any US-specification model year. However, when we consider mileage as well, it does appear that 1992 examples benefit from a market premium when compared to examples with similar miles from other model years. From August 2020 through August 2021, 1992 examples outperformed 1991 examples with similar miles three consecutive times. Along the same lines, 1992 examples seem more likely to ‘get away’ with higher mileage and achieve comparable results to lower-mileage examples from 1990 and 1991. From August 2022 through April 2023, three consecutive results for 1992 examples nearly kept up with results for 1990 examples that had significantly fewer miles each time.

Besides rarity, is there justification for this premium on 1992 US-specification cars? Some argue that the F40 was a work in progress throughout its entire production run, and each model year featured better build quality and craftsmanship than the last. With the European-specification model, things are more complicated, as that version also evolved in several other ways throughout production. For example, later European cars feature catalytic converters, generally seen as a negative hit to their value. Meanwhile, US-specification F40s were catalyzed from the beginning, and their configuration was generally more static from year to year than that of the always-evolving European model.

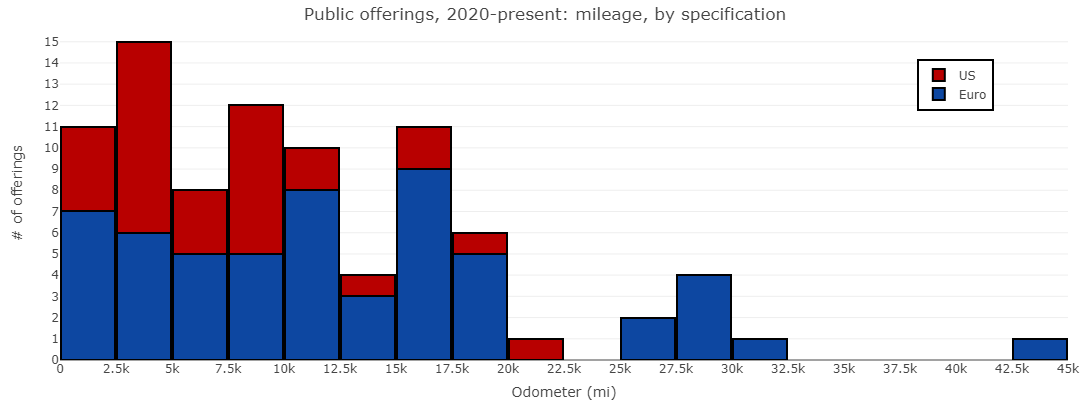

Mileage, by specification

In Part I we looked at the amount of mileage that F40s are offered with. Now let’s break it down by specification.

US-specification F40s tend to come to market with fewer miles than their European-specification counterparts. The median mileage for US-specification offerings is 7,243 mi, while the median for European-specification offerings is 10,886 mi (17,520 km), or 50% more. With mileage being such a determining factor in the value of an F40, does this explain why US-specification examples tend to sell for more money?

On the right is mileage compared directly to auction results, broken out by specification. This uses data from 2022 to present, during which prices have been more stable (compared to the rapid climb in 2020-2021). By doing this breakdown, we can see that the gap in value between the specifications is closed significantly when mileage is put on an even playing field, with most of the data points from one color falling in line with neighbors from the other color.

In other words, when controlling for mileage, European and US-specification F40s often achieve similar results to each other at auction, and a large part of the value gap between the specifications comes from the fact that US examples are usually offered with lower mileage.

However, a sizeable gap does remain, particularly when looking above the $3m mark, where several US-specification results are simply in another league when compared to European-specification results featuring similar mileage.

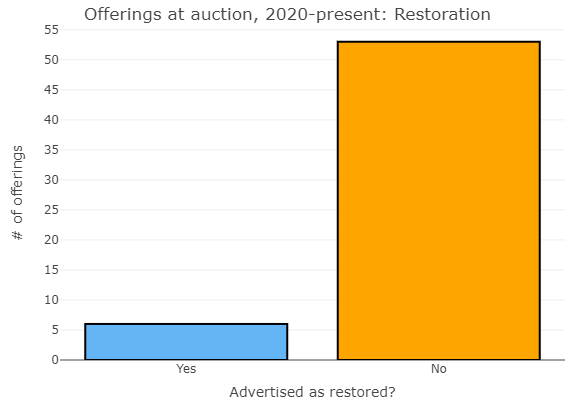

Restoration

We might associate a Ferrari restoration moreso with something like a 250 GTO than with a more modern car like the F40. However, with even the last F40 examples being more than thirty years old at this point, full restorations are already happening. Nevertheless, the vast majority of F40s that hit the market are unrestored. For this analysis, ‘restoration’ means a cosmetic and mechanical overhaul, and does not include just an engine and/or gearbox rebuild.

Does restoration have an effect on market value?

The six restored offerings in this analysis come from four chassis (two were each offered twice) and give us five results to look at. At first glance, it is interesting to see that these restoration results mostly hug the market average quite well. However, as we learned from Part I, we should look at these results by European vs. US specification. Hover over the data bubbles to see the specification of each. By doing this, we see that three of the offerings sold above market for their specification, and two sold below. One of these results, $2.75m in January 2023, involved a heavily-modified example in addition to being restored. We will address modified F40s later. Here, let’s focus on restorations that returned the car to factory configuration.

| Date | Specification | Odometer | Result, USD | Result vs. market (approx.) |

| 20 May 2023 | European | 17,250 km | 2,287,798 | -3.2% |

| 23 Oct 2022 | European* | 26,822 km | 2,490,451** | +10.9% |

| 20 Aug 2022 | US | 15,542 mi | 2,310,000 | -12.7% |

| 19 Jul 2021 | European* | 25,984 km | 1,369,685 | +13.0% |

Two results above market and two results below. Both above market involved chassis #80746, an F40 repainted to blue. The other two results are the most compelling to look at, as they involved total restorations where the end product was meant to represent an F40 as if new from the factory, including in color – and both results fell short of the market. The US-specification example was likely punished for its mileage being well above the US-specification median.

Meanwhile, the European-specification example came to market with mileage right at the average for its specification. A result 3.2% below market is within a margin of error that one could fairly attribute to ‘any given Sunday’ on the auction block. However, when you consider that this car had several things going for it (‘non-cat/non-adjust’ configuration, Classiche certification, books and tools included, original body/engine/gearbox), one conclusion seems to be obvious, at least for this result. The comprehensive restoration, and however much money went into it, did not motivate bidders to open up their wallets any wider than for an unrestored example of like character.

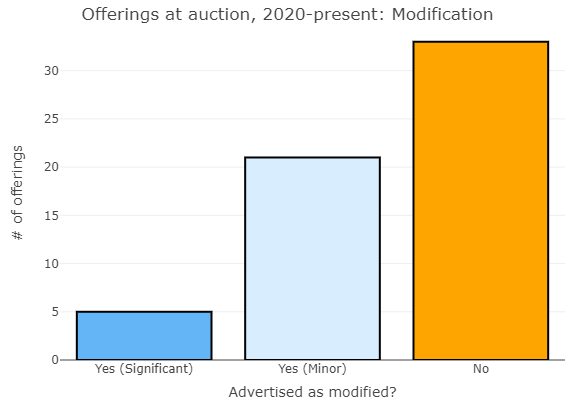

Modification

The F40 was an absurdly fast car for its time, and few owners felt the need to upgrade it via third-party modifications. However, several road F40s were converted in period or soon thereafter for track use, and many of these remain in their modified configuration today. Since 2020, there have been five auction offerings of significantly-modified F40s across three chassis (two were offered twice each). Only one of these offerings has a public result, so we will look at that one specifically.

Right: ‘minor’ modification denotes something on the level of an aftermarket exhaust (very popular on the F40) or US-specification aluminum fuel tanks in a European-specification example that would normally have rubber bladders.

| Date | Specification | Odometer | Result, USD | Result vs. market (approx.) |

| 28 Jan 2023 | European | TMU | 2,750,000 | +23.6% |

| 20 Aug 2022 | European | TMU | Not sold | – |

| 23 Jan 2022 | European | 13,876 km | Not sold | – |

| 12 Dec 2021 | European | 13,854 km | Not sold | – |

| 12 Jan 2020 | European | 16,200 km | Sold after auction | – |

This example, chassis #80782, was sold by Barrett-Jackson at their Scottsdale auction in January 2023. It had previously been offered by RM Sotheby’s in a sealed-bid online auction the summer prior, failing to meet (an unpublicized) reserve. Barrett-Jackson consigned the car with no reserve, so it was going to sell no matter where the bidding ended. The result surprised many in the Ferrari community due to the extensive deviations from factory specification, non-standard paint color (at least twice repainted, first yellow, then gray), heavy track use in the 1990s, and unknown (but probably high) mileage.

Hindsight is 20/20, but this result is a good example of knowing your audience. At Barrett-Jackson Scottsdale, this F40 was surrounded by resto-mods of all shapes and sizes. The Porsche Carrera GT sitting in front of it was not modified but featured its own repaint to a non-standard color, and there was a Lamborghini Diablo in a custom purple mere yards away. Purist Ferraristi might look at an F40 like this and estimate what the car would be worth unmodified, and then subtract the estimated cost of returning it to stock in order to figure out what they will bid. Fans of hot rods and tuner culture, on the other hand, might start from that unmodified value and then add whatever cost they think they have saved by not having to commission the modifications themselves.

Originality

The terms ‘original’ and ‘restored’ are often thought of as mutually-exclusive terms, but in truth, they are not. A car can be restored with a great deal of sympathy towards the original components and presentation. Conversely, a car that is referred to as ‘original’ simply because it has never been restored could potentially be anything but – for example, if that car was ever extensively modified, received an engine or gearbox replacement, was repainted, or had body panels replaced after an accident. Still, there is generally an inverse correlation between originality and restoration, and between originality and age. As F40s grow older each year, fewer retain their original paint and components, due to wear and tear and exposure to the elements.

For this analysis, I have considered the status of four select components commonly scrutinized for their originality – not just on an F40, but any collector vehicle. These are the bodywork, paint, engine, and gearbox.

How does the chart on the right work? Simple – for each of those components that is explicitly advertised as original, the car gets a point, up to a maximum of four. Unfortunately, insufficient detail in listings fails us here. Are nearly half of auctioned F40s actually being offered without a single original component from the four considered? Unlikely.

A lack in publicized detail on originality can come from multiple angles. One, the seller may know the originality is high, but expects serious buyers to make such inquiries directly and privately. Two, the seller may know the originality is low, and decides not to kill their own offering in the listing description, leaving the truth, again, for inquiries from serious buyers. Three, the seller may know the originality and mentions it in the listing, but only in vague terms such as ‘highly original’, ‘mostly original’, or ‘matching numbers’ – a term which means different things to everybody, ranging from just the engine being original to every major component in the car. Finally, the seller may simply not know the originality, or be unable to confirm it.

For Ferraris specifically, many are offered with Classiche certification, which includes an inspection by the manufacturer of the originality of the body panels, engine, and gearbox. However, many of the F40s featured in this analysis had this certification done 10-15 years ago, and those components could have been replaced in the time since. Thus, I only counted recent Classiche certifications (relative to the sale date) as explicit indications of component originality. For more on Classiche certification, I have a section dedicated to it in Part I.

The general belief in the collector car world is that higher originality translates to higher value, all else equal. Shortcomings in auction descriptions leave a data-driven analysis on this topic somewhat infeasible. We cannot necessarily assume that omission of detail on originality is confirmation of unoriginality. At least, for those in the trade of F40s, the data above can provide an idea of how many competing offerings a seller can leapfrog by describing all original components possible.

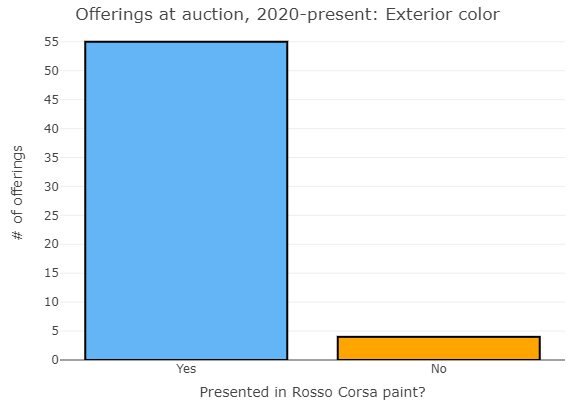

Repaints outside of ‘Rosso Corsa’

As I detailed in Part I, every F40 left the factory in Rosso Corsa paint, often colloquially referred to as ‘Ferrari red’. Only customers on the level of the royal family of Brunei got Pininfarina to give them the closest thing there was to a factory non-red example.

Ferrari’s general disapproval of non-red F40s has not stopped some owners from having third-party shops repaint their car. With over 1,300 examples produced, a fair few have received this treatment over the years. Nevertheless, the vast majority of F40s come to market in the classic Ferrari red color.

Let’s see – four offerings outside of Rosso Corsa, across two chassis, with each being offered twice. If that sounds familiar, it is because we already saw both of these cars in the ‘Restoration’ section of the report. We also saw one of them in the ‘Modification’ section, and the other appears again later in the ‘Notable prior ownership’ section. The significantly-modified car has race history as well – another variable I track outside the scope of this report. Needless to say, these cars have multiple points of differentiation from a typical F40.

| Date | Specification | Exterior color | Restored | Modification | Result, USD | Result vs. market (approx.) |

| 28 Jan 2023 | European | Grigio Nardo | Yes | Significant | 2,750,000 | +23.6% |

| 23 Oct 2022 | European | Blue | Yes | Minor | 2,490,451* | +10.9% |

| 20 Aug 2022 | European | Grigio Nardo | Yes | Significant | Not sold | – |

| 19 Jul 2021 | European | Blue | Yes | Minor | 1,369,685 | +13.0% |

With so much going on with these two cars, it is hard to isolate the market value effect of just the paint color. Typical professional opinion would have you believe that a custom repaint lowers the value of most collector vehicles, but here we have all three known results at above-market prices. Side note: you are reading that correctly – the market judged the blue F40 to have increased in value by more than $1m, or 82%, in just fifteen months. This might sound suspicious until you notice that each result beat the European-specification market by a similar percentage; the market as a whole was climbing just as quickly. Refer back to Part I for more on this.

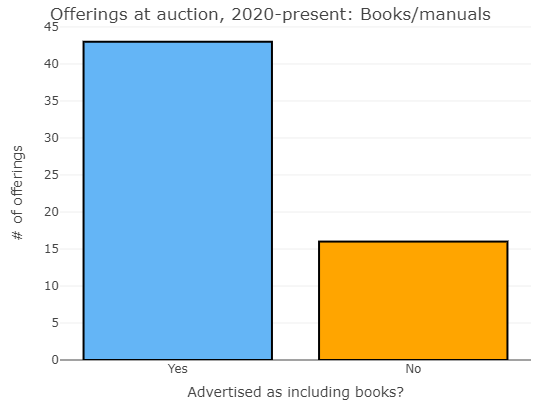

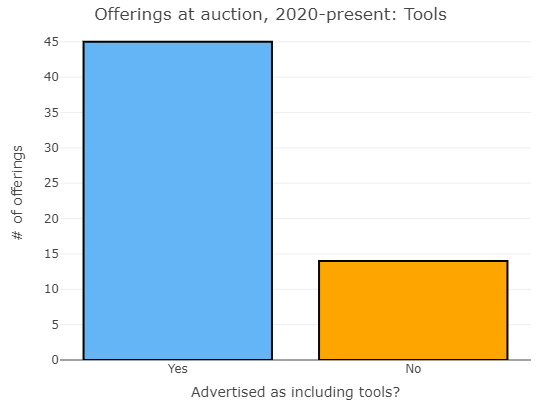

Books, tools, and Schedoni luggage

Every F40 came new from the factory with owner’s manuals and a tool kit – typical items for any classic sports car, and neither of which most owners ever substantially interact with. Still, these items frequently get a mention when they are included with the offering of an F40, as they add to the ‘completeness’ of the car when present and not lost over time.

Less commonly included with an offering is a set of leather luggage designed and fitted by Italian leather goods manufacturer Schedoni specifically for the F40. This brand has outfitted many Ferraris over the years with similar products. The luggage set features embossed Ferrari and F40 logos, as well as, if specified, the name of the car’s buyer from new. Schedoni luggage was an option at the time of purchase, rather than a standard feature. Many F40s never had this luggage in the first place, and as a result, this item appears with offerings much less frequently than the books and tools.

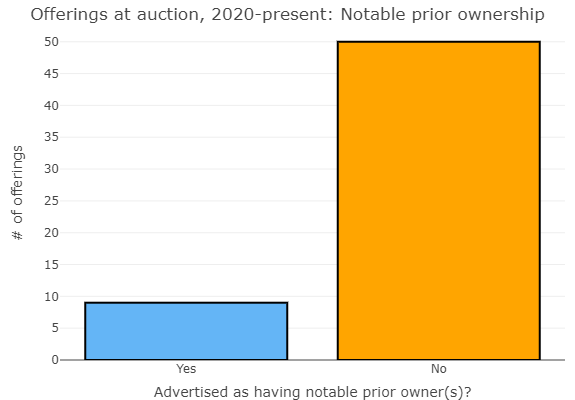

Notable prior ownership

F40s have always been expensive, including from new. As a result, the customers for this car are disproportionately likely to be famous (or infamous) relative to the general public. Celebrities, business magnates, former racing drivers, royalty, and more are among the list of people who have owned F40s. Eventually, many of these owners decided to move on from their cars, which then hit the market with interesting bits of history attached.

If notable prior ownership is in a car’s history file, auction houses and dealers often try to capitalize on that association in their marketing, particularly if that ownership was from new. Noted car collectors with a reputation for an outstanding collection are also mentioned when applicable, even if those people are not famous outside of this context.

Since 2020, 15% of F40s put up for auction have been advertised with some level of notable prior ownership. Does it matter in the results?

The nine offerings give us six known results. Most fall pretty much right on or slightly above the market average for their specification, so notable ownership probably did not do much for their results. The standout data point here is the August 2021 sale of a US-specification example coming out of the collection of noted Ferrari collector Donald L. Weber after his death. Weber had purchased the car new and it spent its entire life in his collection prior to being auctioned by Gooding & Company. This example was offered with only 2,500 mi on the odometer (well less than average), so there is room for debate regarding which factors contributed most to the result. However, Gooding chose to make Weber the focal point in their write-up for this lot. For some buyers, the story can matter as much as the car itself, and when all was said and done, this example sold for 37% above market for a US-specification F40, and 31% above Gooding’s own high estimate, achieving a then-record price.

Concours awards

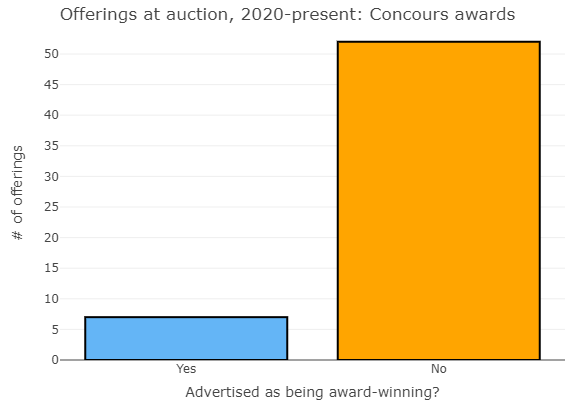

Numerous ‘concours’ events are held around the world where special examples of prestigious automobiles are displayed to the public and judged by experts. Prizes are awarded in various classes to the vehicles that stand out and represent the very best of the remaining stock of their model. The F40 is not quite old enough for an example to win ‘best in show’ at Pebble Beach anytime soon, but there are numerous class awards, particularly at Ferrari-specific events, that the model is eligible for.

Examples that receive concours recognition are then typically advertised as such if later offered for sale. Besides the prestige that comes with recognition, an award from a reputable event is also a sign that a car exhibits excellent condition, high originality, and/or ‘correctness’ to factory specification.

Right: 12% of F40s put up for auction since 2020 were listed as having received a prestigious concours award.

Six of the seven awarded offerings have available results, all six involving US-specification examples. Four results were above market, and two were below, with one failing to meet reserve. The seventh award-winning offering, a European-specification example, failed to sell in a sealed-bid format. Not incredibly consistent results for award-winning cars. On the other hand, Gooding & Company achieved the standing F40 record result at Pebble Beach 2022 with an example that had cleaned up at the 2021 Ferrari Club of America Annual Experience, winning the Coppa Bella Macchina, Outstanding Supercar, Platinum, and Coppa GT awards – the Platinum award via a perfect score.

Auction results vs. asking prices

Let’s compare asking prices from dealers and private sellers to the prices that F40s are actually being bid to at auction. While auctions are largely left to the collective value judgment from a pool of bidders, for-sale listings have fixed prices often determined by one person, which may get negotiated down by a buyer. Are these sellers asking realistic prices from the outset, or are they pricing cars optimistically with the expectation of getting haggled down?

Date of asking price reflects date of observation on my end, not necessarily the initial listing date or sell date. A listing can be shown more than once here if it was still up during subsequent observations.

At a quick glance, it appears that F40s are generally offered at ‘fair’ prices from fixed-price sellers, compared to what the buying market is willing to pay; asking prices seem generally well intermingled with auction results. A deeper look, however, shows that from around May 2023 through much of the rest of the year, there were several for-sale listings priced ambitiously considering the mileage carried. Perhaps the sellers of these examples became a little too wide-eyed when looking at auction results of lower-mileage examples.

Auction results vs. estimates

Many auction houses, particularly those who operate in person, provide price estimates for their offered vehicles. Estimates are typically quoted in ranges and are meant to help guide bidders. They also make for great drama for the auction audience, as rooms are typically at their fullest in the lead-up to the lot with the highest estimate. Estimates do not come without an auction house’s own politics and sales strategies, but for the most part, they are professional valuations of vehicles by people who trade in them. Let’s use them to compare market predictions to market reality. We can draw some interesting conclusions when we compare these valuations to the subsequent results that actually occur.

Here we can see, via color, how each result compares to its estimate (using the midpoint whenever the estimate was provided as a range). Green indicates results that overshot the estimate, white indicates results that exactly matched it, and red indicates results that underperformed the estimate.

This chart provides another perspective into the shifting market sentiment that I described in Part I. Note the flurry of dark green bubbles from August 2021 through August 2022. In this time, four results beat their estimate by at least 40% and five results beat their estimate by at least 30%. The top six performances vs. the estimate in the entire analysis all occurred in this timeframe. The F40 market was extremely hot, and results were consistently beating expectations. Then, estimates were finally adjusted to the hot market, just in time for results to flatten or even cool off. After August 2022, 16 consecutive F40 offerings failed to beat their estimate over the span of a year, with 15 falling short and 1 matching it. Finally, in August 2023, this cold streak was broken by RM Sotheby’s at Monterey car week with a record-setting, European-specification example. From that month through today, expectations and results have largely been in line with each other, only differing by single-digit percentages in either direction.

Have questions?

Get in touch with me directly. Or, join the discussion about this report over at FerrariChat – we have an active thread going.

Andrew Riedell

Founder, Data Driven

Footnotes

- Auction results, specific chassis history and details, and certain facts and figures are available courtesy of the relevant auction houses and their research made available as part of their listings.

- Certain auction results are courtesy of Hammer Price.

- Several facts and figures about the F40 and other Ferrari supercars are available thanks to the research of noted Ferrari experts who have graciously shared them online, in particular Joe Sackey and Marcel Massini.

- Asking prices are available courtesy of various major classifieds websites, whose listings are in turn available courtesy of various dealers and private sellers.

- Condition ratings are the product of the work of Rick Carey, Sports Car Market, and Hagerty, as credited directly in the relevant section.

- All photographs throughout this report are my own. The headline photo in Part I features 1989 European-specification chassis #80022 as displayed at the Amelia Island Concours in Florida in March 2022. The headline photo in Part II features 1991 US-specification chassis #89767 as displayed at the Audrain Auto Museum in Rhode Island in May 2022.