Ferrari F40 (1987-1992)

Note: This analysis is chart-heavy and is best viewed on a larger screen like a computer or tablet. Many of the charts are interactive, so be sure to click around.

The vehicle | The data | European vs. US specification – differences | European vs. US specification – values | Model year | Color, drive side, and wheels | Mileage | Condition | Owner count | Classiche certification | Catalytic converter, adjustable suspension | Windows | Auction house | Location | In-person auctions vs. online auctions | F40 vs. Ferrari’s other flagship supercars | Part II | Epilogue

The vehicle

The F40 was Ferrari’s flagship supercar from 1987 to 1992. Created to celebrate the company’s 40th anniversary, it was famously the last model that Ferrari’s founder Enzo signed off on. Approximately 1,315 examples were built to meet extremely high demand, making it easily the most produced of Ferrari’s five modern flagship supercars (288 GTO through LaFerrari). A few race variants of the F40 were also manufactured – the LM, GT, and GTE. This market report focuses on the road car.

The data

This analysis covers January 2020 to March 2024 as of the last update. It includes a complete set of 59 public auction results globally, 46 professional estimates (valuations) provided by auction houses as part of those offerings, and a select set of 99 for-sale listings across 35 different chassis since summer 2021. All prices have been converted to USD where appropriate and are not adjusted for inflation. All auction results are inclusive of a buyer’s premium where applicable. This applies not just to sold lots but also to high bids on unsold lots, because the inclusive price is what the bidder was willing to pay if the bid had met reserve and the lot sold. Collectively, I refer to sales, high bids, asking prices, and valuations as ‘price events‘ – occurrences in time that help to establish market value for a vehicle model. Here are all of the F40’s price events together in one chart:

Above: Click on an item in the legend to hide it in the chart, or to bring it back. Draw a box to zoom in. These functions work on all similar charts in this report.

At the start of 2020, the F40 market average was around $1.2m USD, based on auction results. This held for another year or so, before a few auction sales at around $2m in Spring 2021 began a rapid upward climb. In August 2021, Gooding & Company sold an F40 for $2.89m during Monterey car week, a record price at the time. By the end of 2021, the F40’s lagging market average sat at around $1.9m USD.

In 2022, Mecum bolstered that Gooding result with a $2.75m sale in January at Kissimmee. From there, we saw a number of results in the mid-to-low 2’s over the next several months. In August, Monterey car week swung around again, where Gooding and RM Sotheby’s both shattered the record from the prior year. Gooding’s F40 sold for $3.97m, which raised the record for the model by more than $1m, and which more than doubled the result that that very same example had achieved in 2018. RM sold their F40 for $3.86m, an amount that would have easily been a record itself if Gooding had not sent their offering across the block a day earlier. 2022 closed with a market average of around $2.5m USD. Those two Monterey sales remain the high water mark for public F40 sales today – by a large margin.

In 2023, Mecum again kicked things off in strong fashion at Kissimmee, achieving $3.14m with an F40, the fourth example to cross the $3m mark publicly. In fact, last year saw the fourth, fifth, sixth, and seventh examples to ever sell publicly for over $3m, with the last two coming at Monterey car week in August. However, 2023 also saw a flattening of the overall market for the first time in a few years. Those high sales mostly involved very low-mileage examples, which still failed to challenge the top Monterey 2022 results. As 2023 ended, the F40 market average sat just where it started the year, at around $2.5m USD.

2024 has already seen the eighth and ninth F40s to cross $3m, although one was a repeat appearance from 2023. As of March, the market average for an F40 is around $2.7m USD, an amount perhaps slightly inflated by the recent double appearance of an extremely low-mileage, high-value example.

Does ‘market average’ mean that any road F40 should sell for that price today in a fair deal? No – there are other factors to consider, because not every F40 is the same. First, there are different specifications as new from the factory. Second, even identical vehicles from new are not like stock shares; they are not fungible. Mileage, condition, originality, history, etc. – they all add up to variations in valuation from one example to the next. Fortunately, we have plenty of data points to be able to dig deeper into the numbers. The F40 is special and rare enough to qualify for even the most prestigious collector car auctions, yet ‘common’ enough to show up at them fairly often.

European vs. US specification

Not every road F40 is the same, even from the factory. The most notable variance came as a result of differences in safety and emissions regulations between the United States and most other major markets in the late 1980s. Whereas the F40 started selling in Europe in 1987, Americans had to wait until 1990 to get their version. When it arrived, it featured several alterations from the original model.

- An extended front splitter protruding further from the nose

- Thin, black impact bumpers wrapping each end of the car

- Revised front side lights, and added rear side lights

- Deleted fog lights on the rear bumper

- A central brake light on the rear decklid

- Reinforced chassis and bodywork

- Mandatory catalytic converters (European cars originally were non-catalyzed)

- At least 25 more horsepower compared to the European model…

- …saddled by an extra ~160 lbs of dry weight

- Revised final drive and gear ratios

- Smaller, aluminum gas tanks rather than the larger, rubber bladders as on the European model

- No adjustable suspension option as eventually offered on the European model

- Different seats and seat belts

- Air conditioning as standard (an option on European cars)

- A few other minor changes

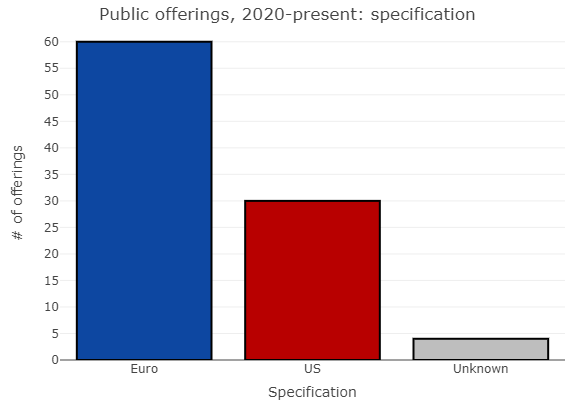

Of the ~1,315 road F40s produced, 211 were in US specification. This leaves the European, or ‘Rest of World (RoW)’, specification model more than five times as common as the US-specification model. As a result, the European-specification model is more commonly seen offered for sale.

‘Public offerings’ on the chart to the right includes auctions as well as for-sale listings from dealers and private sellers. I aggregate for-sale listings from several major classifieds that cover North America, Europe, and affiliated countries. I only collect listings that contain an asking price and/or a chassis number, and some listings provide neither. Further, many F40s are offered and sold more discreetly and without advertisement. Thus, the actual number of F40s offered for sale since 2020 is greater than what is presented in this chart and throughout the rest of the analysis.

Whichever F40 specification is ‘superior’ is left to each’s opinion, but when it comes to market value, rarity talks. Let’s compare the specifications by performance at auction, incorporating both sell prices on sold lots and high bids on unsold lots:

There certainly is a variance in market value between the two specifications, one that ballooned in 2021 and has held mostly steady since, with some ‘tentpole’ effects for the US specification around the 2021 and 2022 Monterey auctions. Currently, the US-specification average sits at $2.97m USD, while the European-specification average sits at $2.46m. Further, of the aforementioned eight unique F40s to sell for more than $3m, all but one have been US-specification examples.

Note that the average trendline for each specification on its own is less ‘zig-zaggy’ than that for the F40 market as a whole. Some of the price instability in the overall trendline is thus attributable to a varying mixture of European and US-specification examples hitting the market and each result pulling the overall average in the direction fitting the specification average. That February 2023 visible downward blip in the overall average line was due to a flurry of lower-valued, European-specification examples hitting the market in a short time (five in nine days), rather than a sudden devaluation of the model as a whole.

The above chart looks at F40 sales globally, and the markets that the cars are offered in could affect the results. US-specification F40s trade almost exclusively in North America, while European-specification examples trade around the world, so the markets for each specification are not like for like globally. Thus, this chart is re-examined specifically for the North American market in Part II.

Model year

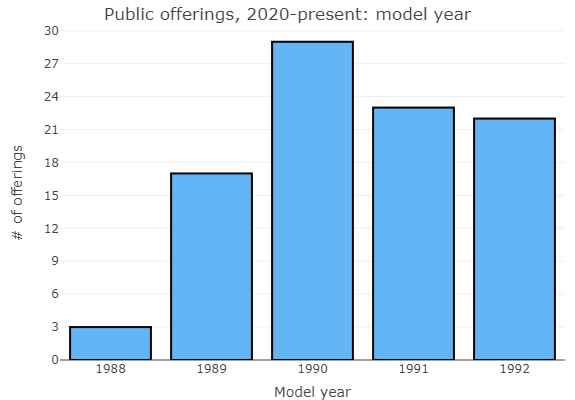

Let’s take a look at which model years come up for sale most frequently.

Do collectors value any particular model years more than others? Looking at the breakdown below, all model years seem to mostly evenly straddle either side of the market average line, indicating no real favoritism for or avoidance of those model years. The one exception is 1992, which appears to sell consistently above market. This phenomenon relates specifically to the US-specification cars. I have a section dedicated to this topic in Part II.

Color, drive side, and wheels

Every F40 left the factory in the traditional red Ferrari color ‘Rosso Corsa’ over ‘Stoffa Vigogna’ seats, in left-hand drive, with 17″, five-spoke, split-rim, alloy wheels designed by Speedline specifically for the model. Early examples had a thinner application of body paint that made it easier to see the carbon-Kevlar bodywork’s weave through the layers. While a similar effect is popular today, some owners at the time felt this looked cheap, and as a result of this feedback, later examples featured thicker paint with a less-visible weave.

At least eight road F40 examples were turned around in period and sent to longtime factory associate Pininfarina to be repainted in other shades, making them the closest thing to ‘factory’ repaints that are known to exist. At least seven examples were converted to right-hand-drive in the same fashion. These conversions were done for the royal family of Brunei, and most are still sitting in the somewhat-infamous collection. Of the few that have ended up in other ownership elsewhere in the world, none appear in this analysis’ data set.

However, many more F40 examples have been repainted by various shops over the years – a few are pictured above – and some of these feature in this analysis. The market value effect of repaints outside of ‘Rosso Corsa’ is explored in Part II, alongside several other aspects of originality and modification.

Mileage

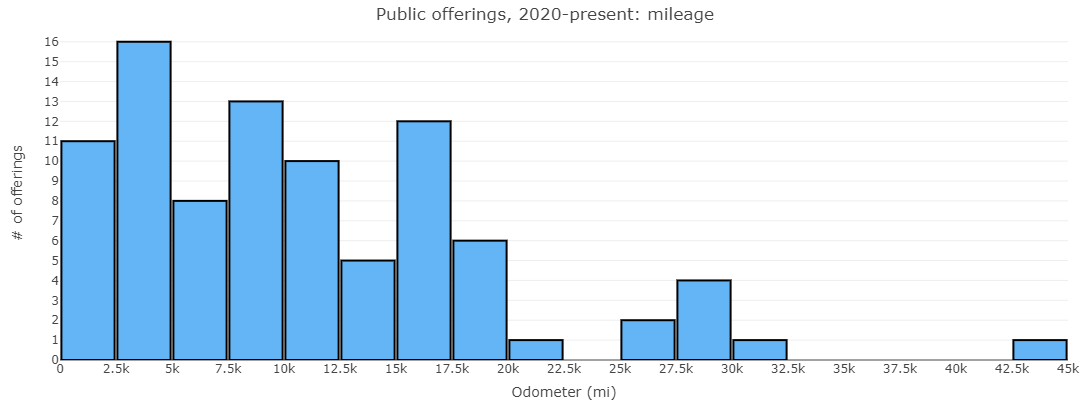

Mileage often has a dramatic effect on the value of a collector vehicle, right or wrong. Let’s look at what kind of mileage F40s are usually offered for sale with (all odometers have been converted to miles where appropriate).

Clearly, most F40s are offered with rather low miles, with the median falling at around 8.8k miles.

Now let’s examine the effect that mileage has on market value.

Higher mileage is represented both by red color and large bubble size. No doubt, the low-mileage examples of the F40 are getting bid to much stronger results than high-mileage examples. In fact, the average line provides a stark, nearly perfect divide between the smaller, green bubbles and the larger, yellow and red bubbles. Buyers clearly value low-mileage F40s higher, and to a significant extent.

From March to August 2023, several particularly low-mileage examples hit the auction circuit, with a comparative lack of high-mileage examples weighing them down. This is arguably why the lagging market average sat at an all-time high at the end of this period, despite some watchers of the F40 market judging it to have cooled in 2023 compared to 2022.

Is the low-mileage price premium justified? It is entirely possible for a 20k-mile example to be better-maintained than a 5k-mile example. In fact, there is an argument that a 5k-mile example is not even broken in yet, and some potential ‘gremlins’ have not yet been exposed and addressed like on the 20k-mile example. However, with identical care, the 5k-mile example will have one quarter the amount of wear on the drivetrain, rock chips on the body panels, road grime in hard-to-reach places, sun damage on the paint, exposure to rain all-around, wear on the seat upholstery, wear on the switchgear, etc. – all of which are simply unavoidable when using an automobile.

Mileage and its effect on market value are further examined for European vs. US specification in Part II.

Condition

Like with mileage, the physical condition of a vehicle can affect its value immensely. A rough F40 can still be worth over $1m these days, but top-tier examples are worth far more. I collected 74 professional condition ratings from Rick Carey’s Collector Car Auction Reports, Sports Car Market, and Hagerty which cover 39 of the auction results presented in this analysis. Ratings go from 1 (concours-perfect) to 5 (junk). I have averaged the scores in situations where the same F40 offering was rated by multiple sources.

F40s essentially never go to auction in poor condition, so the worst cars you see here are in ‘driver’ condition. Do not let the red scare you – I simply constrained the color range to the range of condition actually presented here. In this chart, you can see the value premium that greens (excellent condition) hold over reds and oranges (good condition) in most cases, especially when considered in tandem with mileage (represented by bubble size again).

How much do mileage and condition, combined, drive market value? The effect can be massive for high-dollar, marquee cars like the F40. An excellent microcosm of this happened at the 2022 Monterey auctions, where four F40 examples were sold. Broad Arrow Auctions sold an F40 rated ‘good/very good’ with 26k miles for $1.99m, a very fair result considering that the same example had been bid to an almost identical amount on Bring a Trailer three months earlier. Over the following two days, Gooding & Company and RM Sotheby’s each sold an F40 example rated ‘excellent/like new’ (with 2k and 9k miles, respectively) for nearly double as much money. The Gooding and RM cars were US specification, while the Broad Arrow car was European specification. We have established that US-specification examples trade at higher prices, but the typical variance is nowhere near double.

Right: larger bubble = higher mileage

Owner count

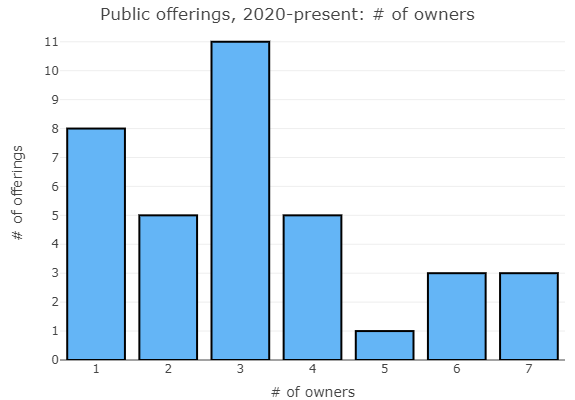

The number of owners that a vehicle has had can matter to certain buyers. Many examples are offered for sale without this information advertised, but generally, a good auction house or dealer will provide this information if it is available. Any F40 is at least thirty-two years old at this point, so most of them have had multiple owners by now. The chart to the right likely underrepresents examples with a high owner count. Why? The more owners a vehicle has had, the less likely it is that the full ownership history is available, and the less incentive a seller has to track this information down for advertisement. Nevertheless, we can still answer some important questions, such as how many F40s turn up from single ownership nowadays.

Does quantity of prior owners have a measurable effect on market value?

Whatever effect there is, it appears to be small. Single-owner examples appear to sell consistently above market average, but otherwise this chart looks almost random with respect to the data points’ color and bubble size and where they fall on the price scale. Multiple 2-owner (and even some single-owner) examples have achieved results well below that of some examples with 6 or 7 owners. While acknowledging the potential for some underlying correlation, at a minimum we can say that other factors are far more important to buyers than owner count.

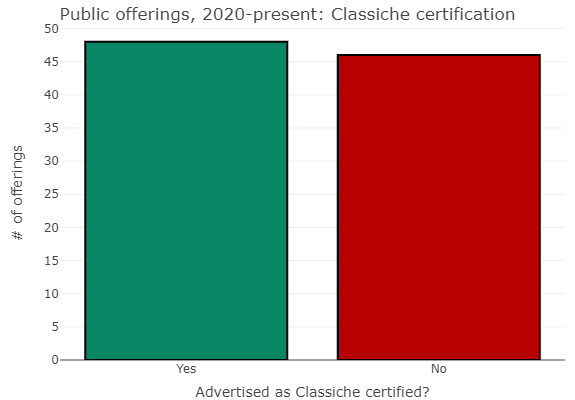

Classiche certification

For Ferrari road cars at least 20 years old, the manufacturer offers to inspect your car (for a fee), assess its originality, and issue a factory certification if it passes what they call their ‘Classiche’ standard. This certification comes with a booklet that Ferrari fans commonly call the ‘red book’. Classiche certification and the booklet are effectively always advertised with a sale listing if the example has obtained them. How many F40s are being put up for sale with a note indicating that the car has been Classiche certified? Just over half.

Regarding sellers who do not want to spend the money to get the certification, and dealers and auction houses who perhaps just fail to include this information in their listings – are they leaving money on the table? Are buyers actually paying more for F40s with Classiche certification?

There does not appear to be a clear difference in value between Classiche-certified and non-certified examples at auction, when looking across the full breadth of the market. However, the story is arguably different at the high end of the market. Of the eight unique examples that have achieved public sales over $3m – not just since 2020, but ever – seven have carried Classiche certification at the time of sale. The eighth had its Classiche certification in progress and pending when it went to auction both times. With this in mind, perhaps Classiche certification is essential to pushing these top-tier examples over the finish line when chasing headline results. This opens a sort of chicken-or-egg debate; it is unclear whether the certification is in fact materially boosting value, or if sellers of (expected) high-value F40s are more likely to bother paying for the certification in the first place in order to secure their car’s top-dollar sale. Nevertheless, this correlation at the top end cannot be ignored.

Catalytic converter, adjustable suspension

F40s are often advertised as being ‘cat’ or ‘non-cat’, and ‘adjust’ or ‘non-adjust’. What do these terms mean? The first pair of terms refers to whether or not an example has a catalytic converter along the exhaust system to reduce harmful emissions. The second pair of terms refers to whether or not an example has an adjustable suspension that allows altering the ride height.

The European-specification model was initially non-catalyzed but was eventually switched during production, and the adjustable suspension was an option once it was introduced. As a result, European-specification examples were ultimately sold in both configurations for both attributes – thus, in four total ‘cat/adjust’ configurations. The US-specification model was only ever offered with a catalytic converter and without an adjustable suspension. Accordingly, let’s just consider the European model here. How often has each configuration come up for sale?

| Catalytic converter | Adjustable suspension | # of offerings |

| Yes | Yes | 7 |

| Yes | No | 9 |

| Yes | not specified | 2 |

| No | Yes | 0 |

| No | No | 18 |

| No | not specified | 1 |

| not specified | Yes | 4 |

| not specified | No | 1 |

| Yes TOTAL | – | 18 |

| No TOTAL | – | 19 |

| – | Yes TOTAL | 11 |

| – | No TOTAL | 28 |

The ‘non-cat/non-adjust’ configuration easily had the most offerings, and each ‘no’ option has been more available to buyers than the associated ‘yes’ option. Three of the four configurations appeared on the market at all, with the only configuration potentially absent being ‘non-cat/yes-adjust’. I say ‘potentially’ absent because ‘cat/adjust’ information is not always provided in listings. Of the 60 European-specification offerings examined in this analysis, 18 contained neither part of the ‘cat/adjust’ information in their listing, and 8 were missing one or the other. Given the holes in the data, it is possible that the relative commonness of ‘non-cat/non-adjust’ being advertised could be affected by sellers’ understanding of that particular configuration’s value on the market. In other words, that configuration might provide an incentive to the seller for it to be noted in a listing whenever possible:

It certainly appears buyers have a preference for ‘non-cat/non-adjust’ examples, which is why that configuration is sure to be advertised when applicable. Note that nearly every example with that configuration sold above the European-specification market average, including the current top sale on the chart. However, this price advantage for ‘non-cat/non-adjust’ examples appears to be largely driven by the ‘cat’ half. If we keep the non-adjustable suspension criteria, but look at catalyzed examples, suddenly we see that most results are below market. The lesson: buyers generally prefer non-catalyzed examples (blue bubbles in the chart) to catalyzed examples (red bubbles), with some exceptions.

The adjustable suspension question is less clear. Examples advertised to have an adjustable suspension make up only four auction results in this analysis. Looking at these results shows two above market average, and two below. With this slim data, it is tough to make a conclusion about the value of adjustable vs. non-adjustable suspension. We need more data points, which could come simply from more consistent and detailed listings from auction houses.

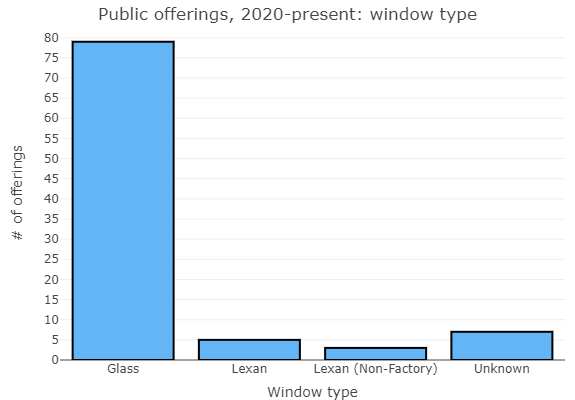

Windows

The F40 was originally designed with light-weight, Lexan side windows which have half-size, sliding openings. Early on, Ferrari largely replaced this design with more traditional, full-size, glass windows which passengers manually wind up and down. Customers of the European-specification model could opt for either style once the glass wind-ups were introduced, while US-specification customers were offered only the glass windows. The sliding Lexan windows lived on in the F40 LM and a few examples of the other racing variants, leading some to associate this window style moreso with the F40 race cars, even though the road model had it first.

European-specification customers may have been offered a choice, but only around 91 of the approximately 1,104 European-specification examples were built with Lexan sliding windows, making them extremely rare. Most of these examples were early builds, although some trickled out from the factory in later model years. Lexan-window examples are so rare, in fact, that the last time one came up for auction was in February 2020. If you are looking for one, you are better off seeking out dealers or private sellers via classifieds. My data set shows four confirmed listings since summer 2021. I only collect for-sale listings that have an advertised price and/or chassis number, so there likely have been more than that put up for sale.

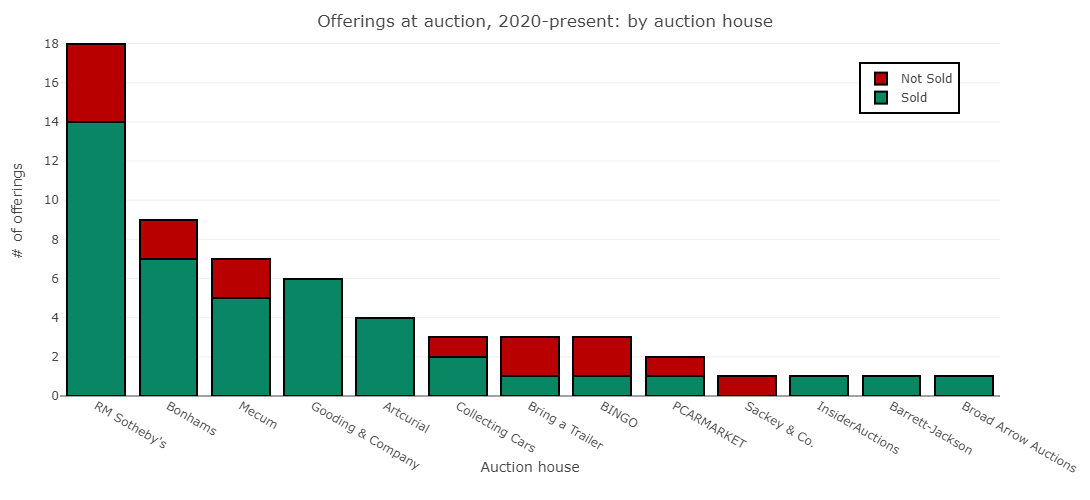

Auction house

RM Sotheby’s auctions the most F40s by a comfortable margin, having offered and sold double that of the next-leading company, Bonhams. Gooding & Company and Artcurial have the best sell-through rates among houses that have auctioned multiple F40s since 2020, with each company selling 100% of their offerings in that timeframe.

| Date | Auction house | Specification | Mileage | Sell price, USD |

| 19 Aug 2022 | Gooding & Company | US | 1,832 | 3,965,000 |

| 20 Aug 2022 | RM Sotheby’s | US | 9,447 | 3,855,000 |

| 13 Jan 2024 | Mecum | US | 8,688 | 3,410,000 |

| 1 Mar 2024 | RM Sotheby’s | European* | 746 | 3,360,000 |

| 19 Aug 2023 | RM Sotheby’s | European* | 579 | 3,305,000 |

RM Sotheby’s subsequently dominates the chart of all-time top-selling F40 examples, although Gooding & Company holds the top spot. Each sale occurred in the last twenty months, and in the United States. Three of the top five occurred during Monterey car weeks, where auction houses typically bring out their best offerings.

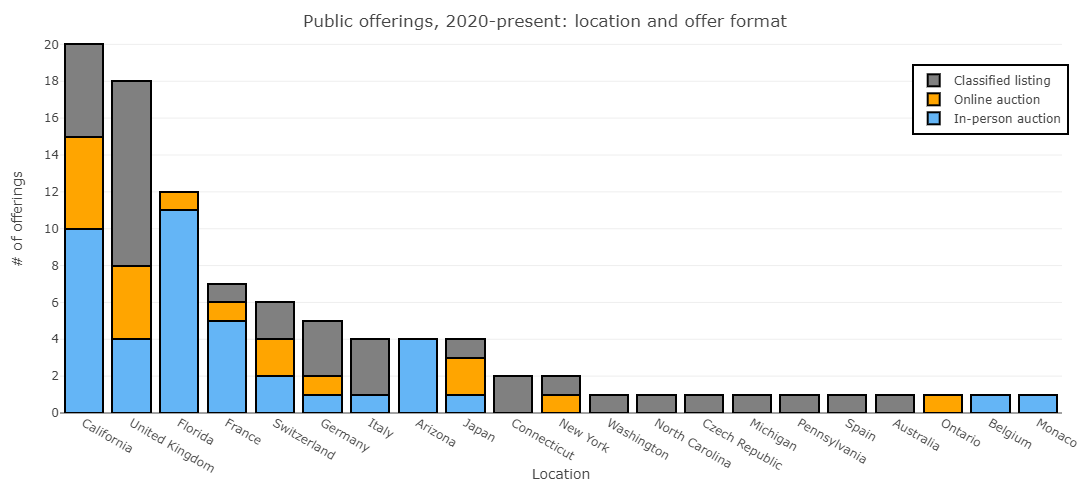

Location

Sellers aim to sell cars in markets that make sense, with a pool of buyers that can yield an excellent sale result. Top-tier auction houses typically hold sales in multiple locations around their home country (or the world) each year, and they deliberately select which cars appear at which sales. Marquee cars like the F40 do not necessarily appear at the first auction event on the calendar after the car is consigned; often they are withheld for the ‘right’ event. Online auctions and for-sale listings from dealers have a similar flexibility, as cars can be moved within large dealer networks with broad footprints, or wholesaled to other dealers in more suitable locations. With online auctions and for-sale listings from private sellers, cars are generally offered from the location of the owner, or nearby.

With all that in mind, where are F40s being offered the most? Let’s compare countries by quantity of offerings, with large countries like the United States and Canada divided into states and territories, respectively.

The United States dominates the ranking; in fact, California holds the top spot on its own. Monterey car week and its associated auctions are a major contributor to this, with multiple F40s crossing the block in most years. Beyond car week, California also leads in online auctions. Given the state’s large population, high concentrations of wealth in the Bay Area and Los Angeles metro area, renowned driving roads, and year-round driving weather in the south, this should be no surprise. Leading the ‘rest of world’ category, the United Kingdom punches above its population weight, with its prolific car culture, numerous prestigious dealers, and affinity for the auction format. Florida and France are carried by their major annual auction weeks at Amelia Island and Paris, respectively.

In-person auctions vs. online auctions

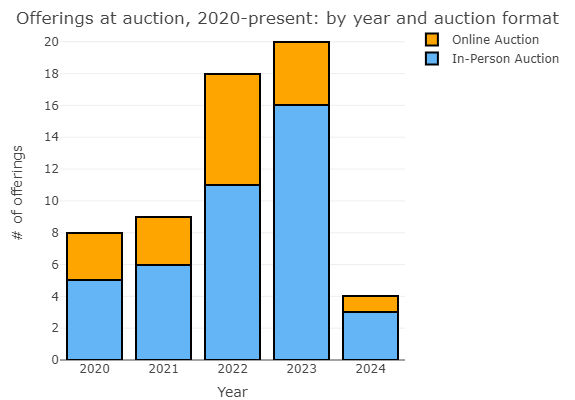

Let’s discuss in-person and online auctions with respect to the F40. Online auctions of collector vehicles have grown massively in the last few years, accelerated by the rise of Bring a Trailer and the COVID-related cancellations of several in-person auctions in 2020.

The first F40s at online auction appeared that year, entirely via traditional auction houses that were forced online by the pandemic. From 2021 on, dedicated online marketplaces like PCARMARKET, Bring a Trailer, and Collecting Cars joined in, while traditional auction houses largely returned to the in-person format.

2022 saw a dramatic increase in the total number of F40 examples offered at auction, exactly doubling 2021. This increase came from both the in-person and online formats. 2023 increased the total even further from 2022, although online offerings actually decreased year-over-year. So far in 2024, we have seen far fewer F40s (4) than last year by this time (10).

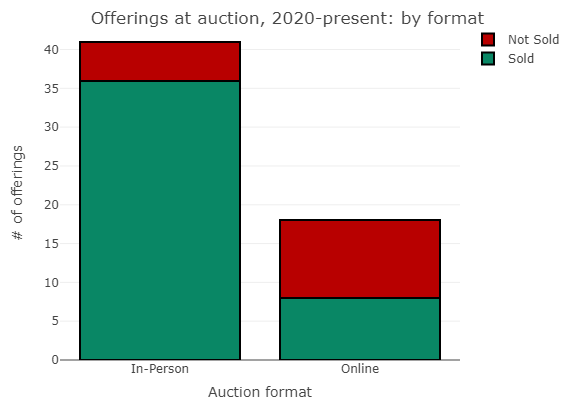

Bidders are willing to buy high-dollar cars like the F40 online without seeing them in person first, but they have some hesitations. The sell-through rate of F40s at online auctions is 44%, half that of F40s at in-person auctions (88%). In fact, while F40s sell better than the average collector vehicle in person, they sell well worse than average when going online.

F40 vs. Ferrari’s other flagship supercars

For a closing exercise, let’s compare the F40 to its predecessor and successors. The F40 followed the 288 GTO (1984) as the flagship supercar within Ferrari’s lineup. The manufacturer then continued the lineage with the F50 (1995), Enzo (2002), and LaFerrari (2013). A sixth car is supposedly on the horizon. Together, this set of five cars (so far) is known by several nicknames, including Ferrari’s ‘five modern supercars’, ‘big five’, and ‘five halo cars’. How do these models compare in value?

As in the F40 charts seen throughout this report, market value data for the flagship supercars is based on auction results, incorporating both sell prices on sold lots and high bids on unsold lots.

Right away, we can see that the average F40 is worth significantly less than any of the other models. It increased in value dramatically from January 2020 to now, but so did the rest of the supercar set. In fact, an F50 is worth about 67% more than an F40. Why is this? Scarcity drives value, and the F40 is easily the most ‘common’ member of the series, with more than double the production of the next most common model. With that in mind, let’s consider the value of each model when weighted by production number.

| Model | Average market value, USD | Number produced | ‘Market cap’, USD |

| 288 GTO | 3.998m | 280 | 1.119b |

| F40 | 2.741m | 1,315 | 3.604b |

| F50 | 4.572m | 377 | 1.723b |

| Enzo | 3.859m | 498 | 1.922b |

| LaFerrari Coupe | 3.904m | 500 | 1.952b |

| TOTAL | 19.073m | 2,970 | 10.321b |

Calculating market capitalization for a car model is a wonky concept for a number of reasons. Further, the consideration of only base road models leaves the LaFerrari immensely short-sold, as another 210 examples were produced in a special, open-top version called the Aperta. Thus, consider this a fun diversion rather than a hard science. With that caveat out of the way, once we factor in production numbers for each member of the ‘big five’, the F40 is by far the most valuable model, more than doubling the value of the F50 and more than tripling the value of the 288 GTO. Many consider the F40 to be the most legendary car in the series, and this data supports that belief from a financial standpoint.

Some Ferrari collectors have made it a goal to obtain the entire set. Currently, it costs about $19.1m to buy all five at average market value. In January 2020, it cost about $11.3m. Adjusted for inflation, the group has collectively appreciated by 41% since then.

The analysis continues in Part II…

If you are still hungry for data, check out Part II. This supplementary report covers several more factors which potentially affect market value for an F40, such as restoration, modification, originality, included accessories, existing notoriety, and more. Part II also compares asking prices and auction house estimates to actual auction results. Additionally, some of the cuts of data discussed in Part I are examined in more detail in Part II.

Have questions?

Get in touch with me directly. Or, join the discussion about this report over at FerrariChat – we have an active thread going.

Andrew Riedell

Founder, Data Driven

tags: ferrari f40 price guide, valuation, appraisal, evaluation, market value, market analysis, market report, price tool